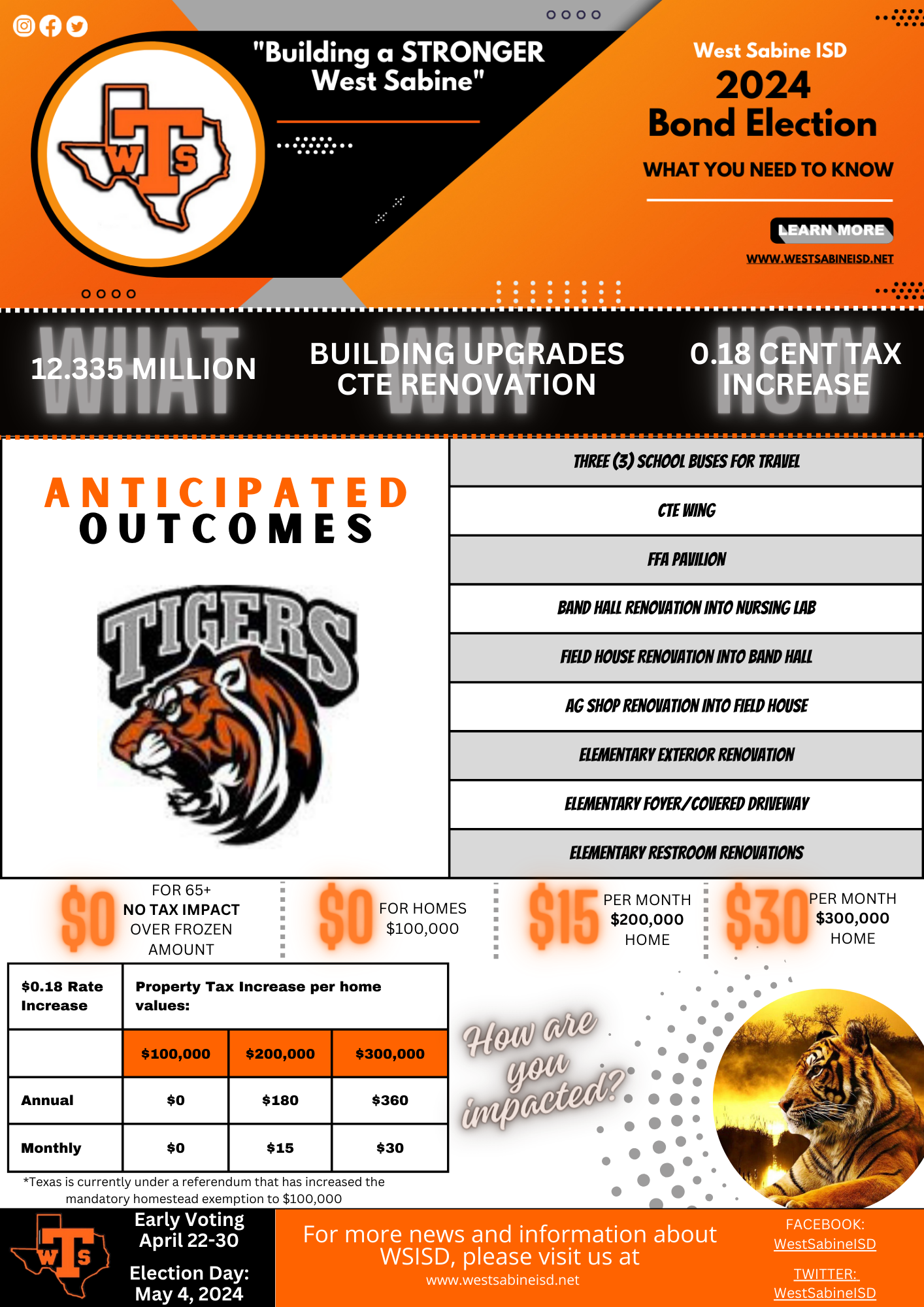

SAISD Bond @ 5%

principal of debt-$32,000,000

estimated interest-$29,564,400

Amortized over 30 years

CISD Bond @ Estimated 5%

principal of debt- $28,430,000

estimated interest- $30,447,000

Amortized over 30 years

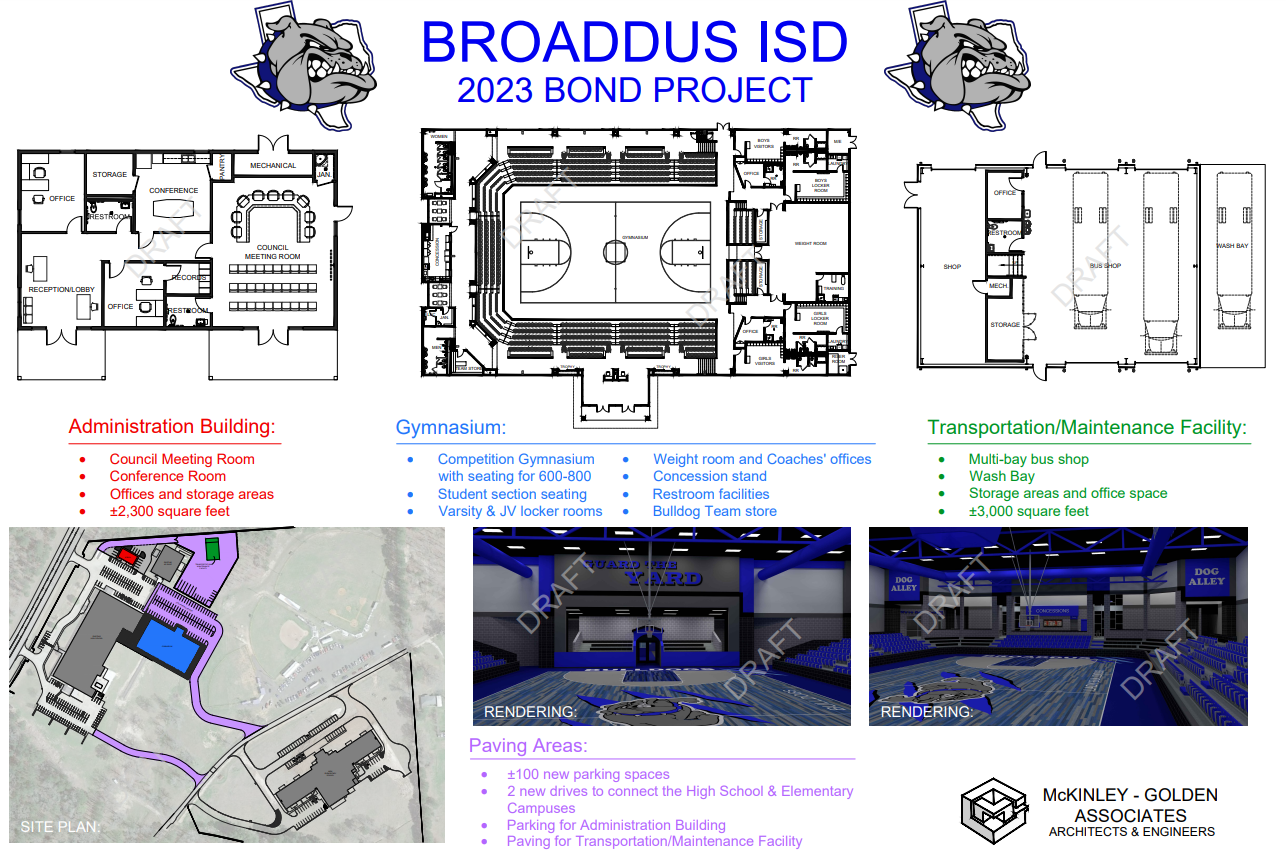

Bond 2023 @ Estimated 4.75%

principal of debt- $13,500,000

estimated interest- 7,157,950

Amortized over 23 years

Bond @ Estimated 4.39%

principal of debt- $47,665,000

estimated interest- $43,595,077

Amortized over 30 years

UPCOMING EVENTS:

Monday | March 25, 2024 | Band Parents-5:00p |

Wednesday | March 27, 2024 | Coffee Talk-WSISD Admin |

Sunday | March 31, 2024 | Goodwill Baptist Church |

Monday | April 15, 2024-5:30 p | Superintendent's Advisory Meeting WSHS |

Plainview Church | ||

Thursday | April 18, 2024-6:00p | Pineland Service Club at WSHS |

Monday | April 22, 2024 | First Day of Early Voting |

Tuesday | April 23, 2024 | Last Day to Apply for Ballot by Mail |

Tuesday | April 30, 2024 | Last Day of Early Voting |

Saturday | May 4, 2024 | Election Day |

School Taxes Include Two Tax Rates

Public school taxes involve two figures that divide the school district budget into two “buckets.”

The first bucket is the Maintenance and Operations budget (M&O), which funds daily costs and recurring or consumable expenditures such as teacher and staff salaries, supplies, food and utilities.

The second bucket is the Interest and Sinking Fund (I&S), also known as Debt Service, which is used to repay debt for capital projects approved by voters through bond elections.

Proceeds from a bond issue can be used to renovate facilities, update building infrastructure, and purchase capital items such as equipment, buses, and technology. By law, I&S funds cannot be used to pay M&O expenses, which means that voter-approved bonds cannot be used to increase teacher salaries or pay rising costs for utilities and services.